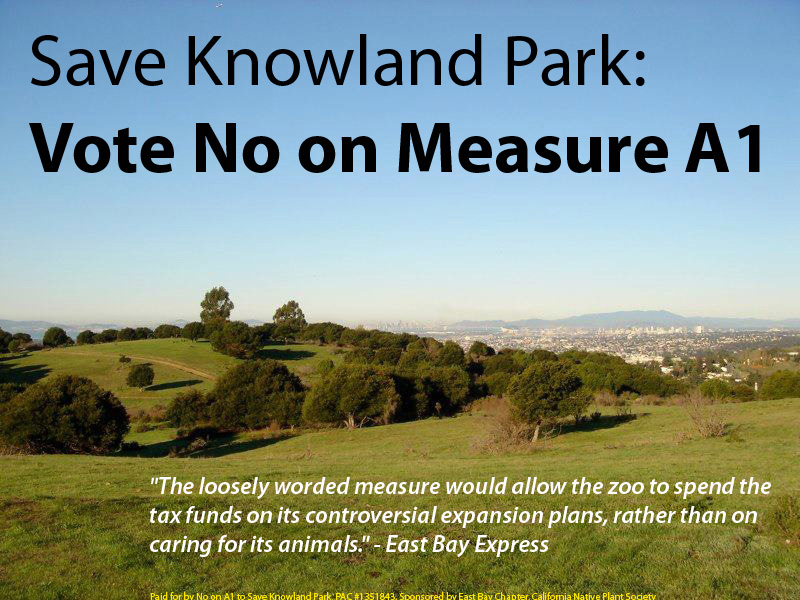

Funds can be used for expanding zoo into parkland, destroying important wildlife habitat and native plant community

Funds can be used for expanding zoo into parkland, destroying important wildlife habitat and native plant community

This parcel tax for the Oakland Zoo is presented as a humane animal care measure, but its stealth purpose is to fund a massive zoo expansion into ecologically rich wildlife and native plant habitat in Knowland Park, Oakland’s largest wildland park. It allows taxpayer funds to be used for building a 34,000 square foot restaurant, gift shop, visitor center and office complex beside a rare chaparral plant community used by many species of native wildlife, including mountain lions and the threatened Alameda whipsnake. Zoo executives refuse to consider environmentally superior locations.

Measure Sections/Documentation

Section 1, Chapter 2.30.010 Definitions, Paragraph H

“Services and Projects” mean the operations of the Oakland Zoo, including but not limited to acquisition of, caring for, and publicly displaying animals, deployment of appropriate personnel, and maintaining, operating, and improving existing facilities; providing and supporting educational and conservation programs involving, without limitation, animals, native habitats, and nature, as well as other Zoo-related programs; community outreach; constructing, expanding, remodeling, renovating, furnishing, equipping, or financing of facilities; keeping visitor fees affordable, and maintaining or improving visitor services. Financing the construction of new or renovation of existing Oakland Zoo capital facilities is within the definition of services and projects. The Zoo operator may use special tax funds to provide services anywhere in Alameda County, but may not use them for programs and services outside of Alameda County.

Expenditure Plan

- Includes: “Repair, upgrade and add animal exhibits…”

- Includes: Improve conservation research and develop conservation center and programming to educate zoo visitors about animal conservation efforts

- “Projects are not listed in priority order and may be enhanced, supplemented, or expanded…”

- “The Zoo may delete a project or service among the examples listed in this Expenditure Plan, may substitute unidentified but similar projects and services for those listed…as long as…consistent with the general categories of projects listed in this expenditure plan.”

- “Because the tax authorized by Measure A1 will be in effect after projects and services listed…are completed or become less responsive to community need, the Zoo may undertake new projects and services consistent with the general purposes listed in this Expenditure Plan.”

Gives tax authority to private body with no publicly elected representatives

This measure would create a troubling precedent of taxing residents to fund a private operator. The nonprofit board running the zoo has no publicly elected members and is not required to follow state public open records laws. A 25-year tax for a privately-run operation, with no true public accountability, is unacceptable.

Zoo already gets public funds from multiple sources and there are many other needs that are higher priority

The zoo already takes in millions of dollars in public funding, including Oakland city funds, dedicated hotel taxes, East Bay Regional Park District funds, bonds money and a multimillion-dollar State Parks grant. Schools, libraries, and many other public programs and services should take priority for new taxes. Zoo executives are saying they don’t have enough funds now to care for the animals they already have, so why are they planning on building a huge expansion, which will further increase their operating costs?

Creates additional burden for low-income seniors seeking exemptions

Low-income seniors who want to apply for an exemption from paying this tax would have to apply each and every year to the zoo operator, creating an additional burden and requiring them to submit their personal financial information to a private entity with no accountability to voters. This is humiliating and inappropriate.

Measure Sections

Section 1, Chapter 2.30.020, Paragraph K:

Exemption applications shall be filed with and processed by the Zoo operator or an administrator selected and retained by the Zoo operator, subject to the approval of the county.

Public funds could be used by zoo for legal defense if a public challenge to the expenditures of the funds is brought

Section 2.30.40, paragraph A:

If this Chapter or the use of special tax funds is legally challenged, special tax funds may be used to reimburse the County and the Zoo operator for their costs of legal defense, including attorneys’ fees and other expenses.

Oversight committee issues

Oversight committee is appointed annually, thus any member may be removed at the end of their term. [Sec. 2.30.050 Subsec E]

- Zoo employees are not expressly precluded from serving on the Oversight Committee, only City of Oakland employees, which they are not.

- There is no provision for any elected official to oversee these tax expenditures.

- If appointments are unfilled, a simple majority of those who have been appointed constitutes a quorum and can act by simple majority.

May only be amended by vote to increase or extend.

Section 2.30.070:

This Chapter may be amended by a vote of the people if the amendment would result in the special tax being imposed, extended, or increased in a manner not authorized by this Chapter as originally approved by the voters. The Board of Supervisors may enact other amendments, including but not limited to amendments necessary to assist the Oakland Zoo in obtaining long-term financing for services and projects.

Follow

Follow